We are living in an era of digital transformation, one ripe with both opportunities and challenges. These challenges, such as how to protect consumer data across the webosphere and what to do about a growing labor shortage, don’t always have easy answers or solutions. Add in the global instability that is upon us, brought about by civil unrest and conflict, the pandemic, and global supply chain issues, and it’s no wonder we tend to question and reconsider every investment we make—whether it’s our time or money.

The climate emergency is also at the forefront. This international crisis is pushing companies and investors to address Environmental, Social, and Governance (ESG) issues with a greater sense of urgency. As much emphasis is now placed on ESG as market demands and ROI. In fact, sustainable finance, which aims to combine economic investment with sustainability objectives, is now a $35 trillion dollar market, Bloomberg reports.

In this age of uncertainty, here’s why sustainable finance matters and how companies and investors can work together to build ESG funds.

The ESG Corporate Agenda

ESG is rising as a top priority on the corporate agenda, but how do we define ESG? Environmental, Social, and Governmental are the non-financial factors used to measure the sustainability and ethical impact of a company or investment. ESG investing quantifies risks that are not covered by traditional financial metrics, such as a company’s carbon footprint, employee diversity, and political affiliations and donations. This is the evolution, to some extent, of social corporate responsibility.

There are several examples in which a corporation could adopt a responsible management approach as well as better governance. This is the case of our member, SK hynix, which acts in all the three ESG criteria:

- Environmental: by reducing gas emissions and using renewable energy;

- Socially: being responsible for hiring talents and promoting development programs; and

- Governing: having a transparent process and independent board members.

Independent ESG research firms produce scores for and assign ratings to a wide range of companies, providing a benchmark for evaluating and comparing different investments. Scores are typical on a 100-point scale. The higher a company scores, the better the company performs in meeting ESG criteria. But it’s not only companies driving the shift to a greener tomorrow. Consumers also play a vital role.

Consumers Consider Sustainability When Making Purchases and Beyond

Consumers now consider sustainability an important factor in their purchasing decisions and will continue to drive the shift to more sustainable business practices for years to come. As the latest Business Marketing Research and Intelligence US micro-shifts study from Meta shows, in 2022, “Consumers will look to connect with brands that reflect their evolving beliefs, and they’re willing to pay a premium for eco-friendly or sustainable products.”

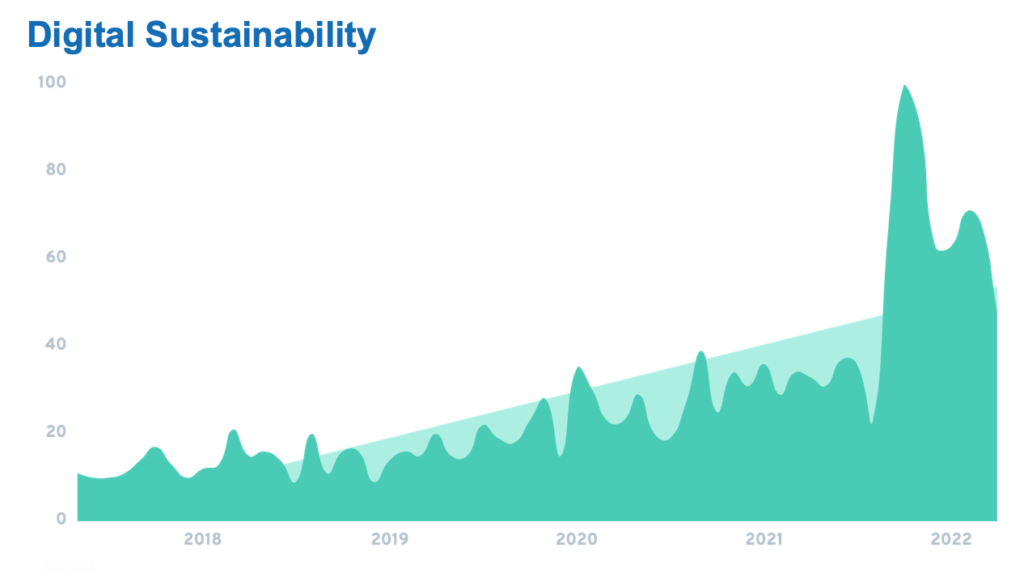

Amid this growth, digital sustainability—the use of technologies, such as software and machine learning, in everyday business applications which have a positive impact on the environment—is one trend that is gaining significant momentum. Until recently, climate-related conversations have focused mostly on the impacts of overconsumption, toxic chemicals and emissions, and physical waste. The following chart expresses growing attention (in number of monthly Google searches for the topic in the US) to the digital sustainability factor.

Companies that use digital technologies for sustainability will not only reduce the harm being done to the environment, but also gain consumer and investor trust.

The Challenge of Investing in ESG Funds

Despite a recent dip in ESG fund performance, investors continue to show interest in businesses that adopt ESG criteria, since they tend to be more profitable and secure. To date in 2022, ESG funds have raised more than $22 billion. In 2021, the ESG market was valued at $120 billion, more than double the $51.1 billion posted in 2020. Sustainable finance presents a number of challenges, which is likely reflected in this recent slowdown.

Perhaps the biggest issue is that not all ESG factors are easily quantifiable, and such factors may not directly translate into earnings growth or enhanced performance. According to the Chartered Financial Analyst (CFA) Institute, “ESG metrics are not commonly part of mandatory financial reporting, though companies are increasingly making disclosures in their annual report or in a standalone sustainability report.” Still, these sustainability disclosures are often skewed toward processes and procedures, not actual performance or a company’s commitment to implementing a certain policy or practice.

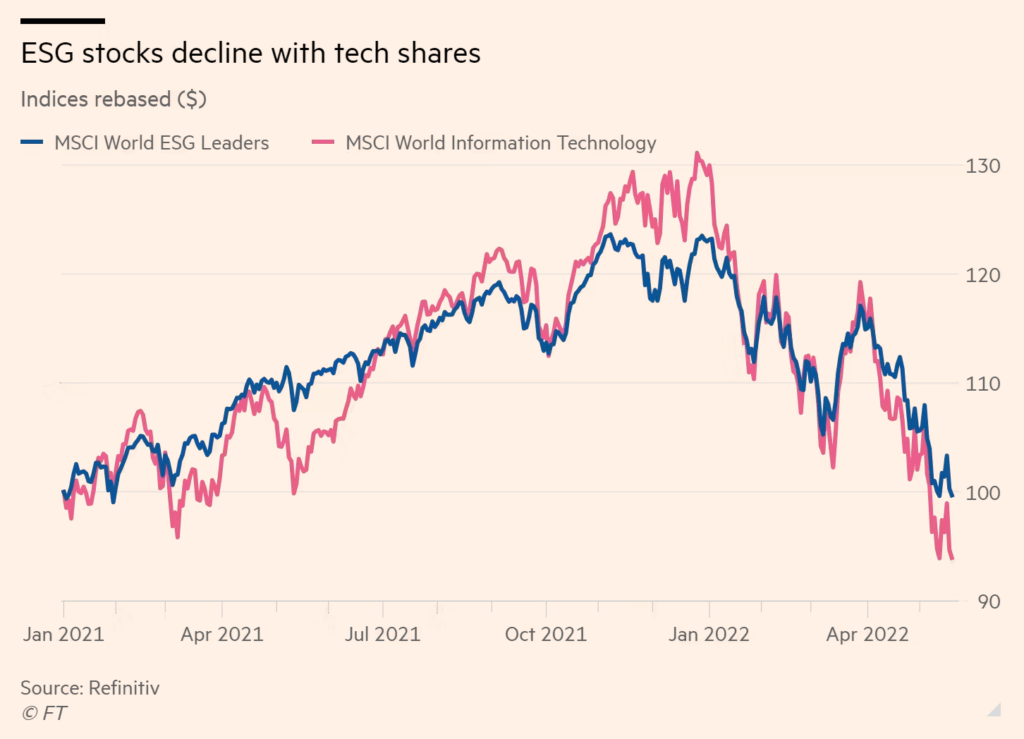

The ratings companies also follow different methodologies in arriving at ESG scores. Applying the same metrics to companies across various geographic locations and industries can make it difficult to compare investments or even make sense of the data.Finally, a wider investor base will be needed to sustain growth of the ESG market. Nowadays, tech companies are the major investors in ESG funds, mainly because “their carbon footprints tend to be lower than peers in other industries, and they have policies in place on issues such as diversity and human rights,” Financial Times reports. And, as the graph below shows, if tech shares decline, ESG stocks also plunge.

To conclude, ESG funds still appeal but inevitably they follow the market. It is certain that more market participants and fresh ideas are needed in order to build broader awareness and attract investors from different sectors.

This article was written by Silicon Foundry editor, Laura Fois.